How to configure tax rates for stores based in Canada - Xero Bridge app

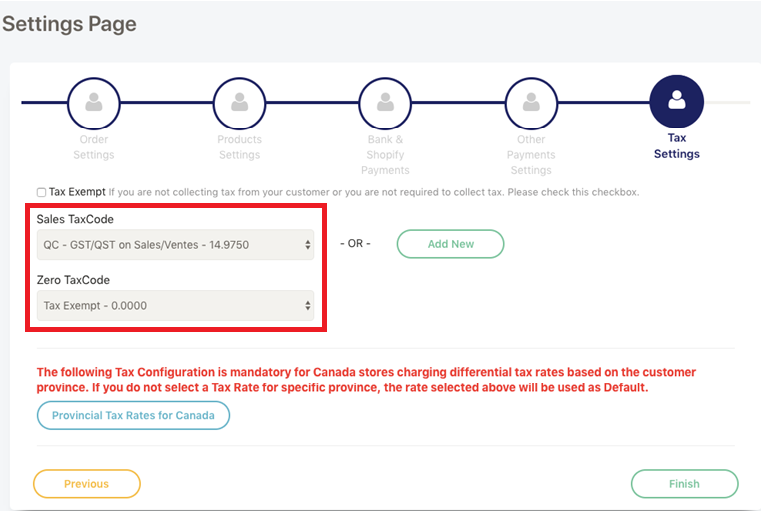

For most stores based in Canada, there are only two types of tax rates that are collected. One is the normal tax rate for sales based on their jurisdiction. The other one is for exempt or zero rated products where no tax is collected.

- Xero Sales Tax Code

This is the tax code for normal products (non-zero rated). This will be based on the Country/Province/State that the business is registered in.

- Xero Zero Tax Code

This is the tax code name for the products or orders that do not have any taxes applied to them. This field usually is Zero rated field or Exempt field.

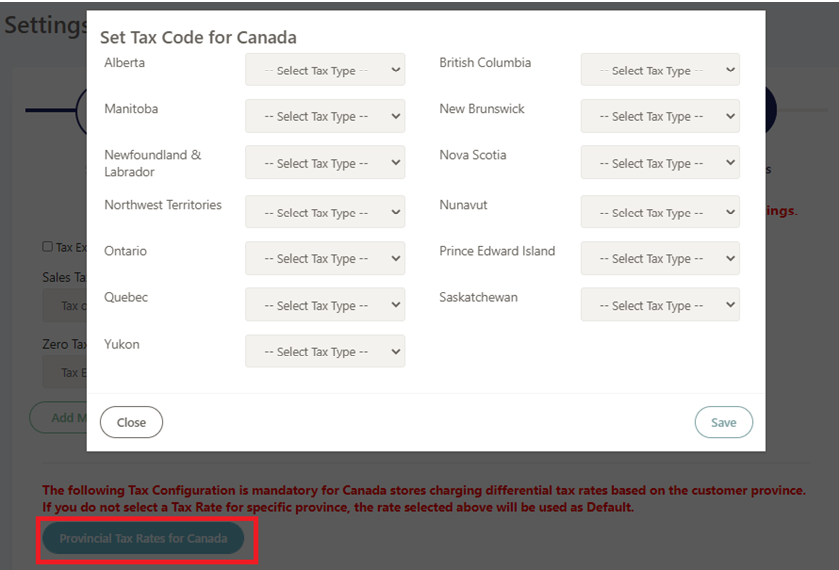

If you charge taxes to other provinces as per Canadian laws, please use the "Provincial Tax Rates for Canada" button to configure the rates for other states. If the taxes are not created already in Xero for province then need to create them first in Xero. After that only those will be available to select from the drop down list in our app. If this selection is left empty for one or more states, the default tax rate from the above screenshot will be applied to that order.