How to configure tax rates for stores based in Australia and New Zealand - Xero bridge app

For most stores, there are only two types of tax rates that are collected.

One is the normal tax rate for sales based on their jurisdiction. The other one is for exempt or zero rated products where no tax is collected.

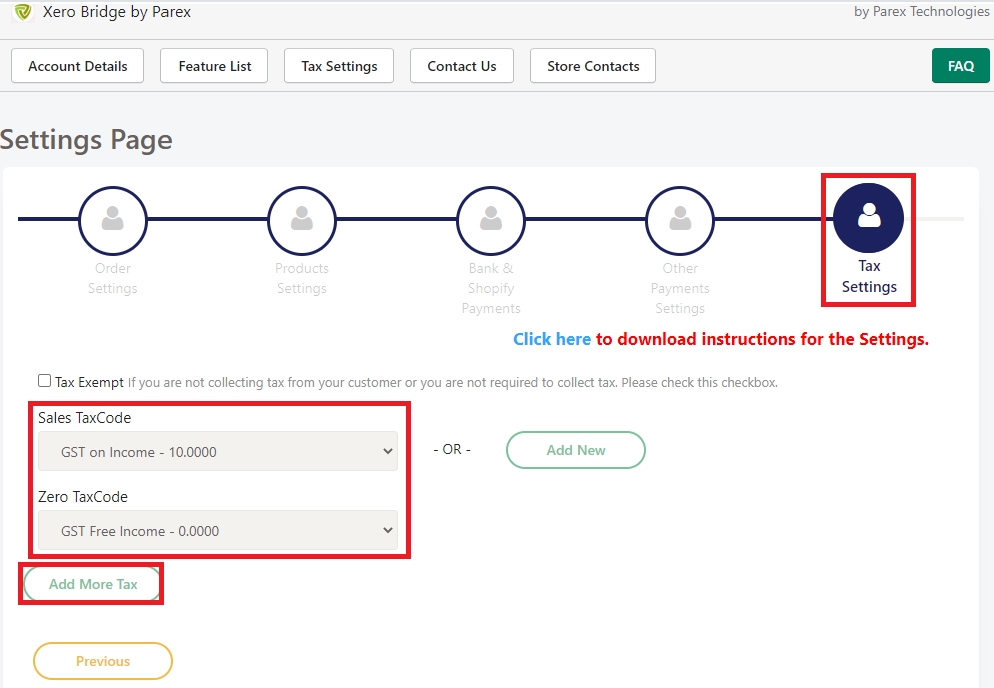

- Xero Sales Tax Code

This is the tax code for normal products (non-zero rated). This will be based on the Country/Province/State that the business is registered in.

- Xero Zero Tax Code

This is the tax code name for the products or orders that do not have any taxes applied to them. This field usually is Zero rated field or Exempt field.

- More Tax Codes

If there are more than 2 tax codes that are required to be configured for other Tax rates, please use the "Add More Tax" button to add the other rates. Our app will match the Tax rate charged by Shopify with these other rates. If our app finds a match, we will use the relevant tax code. If a right match is not found, our app will use the default tax code set in Xero Sales Tax Code.