How sales tax will work with Avalara when using Xero bridge app?

This article provides information on how our app syncs tax data while using Avalara in Xero or in Shopify.

1. Using Avalara in Xero.

Xero does not allow using Avalara from APIs that the apps use. This is the restriction from Xero API for using Avalara tax.

Tax rate "Ava Tax" is available in Xero but that can be used from Xero user interface only. It is not available through Xero API.

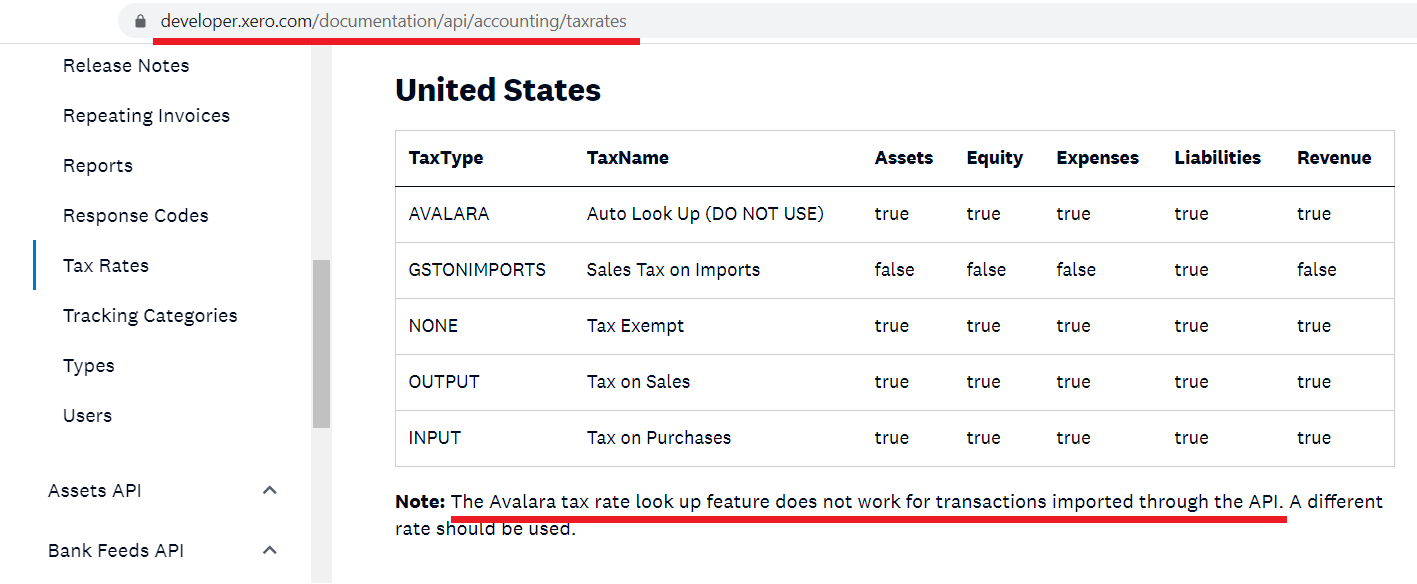

The Avalara tax rate look up feature does not work for transactions imported through the API. You can refer to the below link from Xero documentation for this information.

https://developer.xero.com/documentation/api/accounting/taxrates

Refer to the below screenshot for the same information provided in the link.

2. Using Avalara in Shopify

When there is a tax applied to an order in Shopify, our app will sync the tax to Xero. Our app will select the correct tax code based on the code selected in our app. If there has been no tax charged on the order in Shopify, our app will not consider the tax.

Note: For the stores based in the USA, our app has an option to select the tax rates jurisdiction wise or state wise. If you are receiving the tax for the city, state, and county then you can select the respective tax code against tax rate for each jurisdiction in our app. If you are receiving the flat tax for the states then you can select the state name and configure the tax rates against tax codes in our app settings.