Error: No Tax Code mapping found for Rate: %. Please select Xero tax code from the Tax Settings button above

This article provides the information on cause of this error and its resolution.

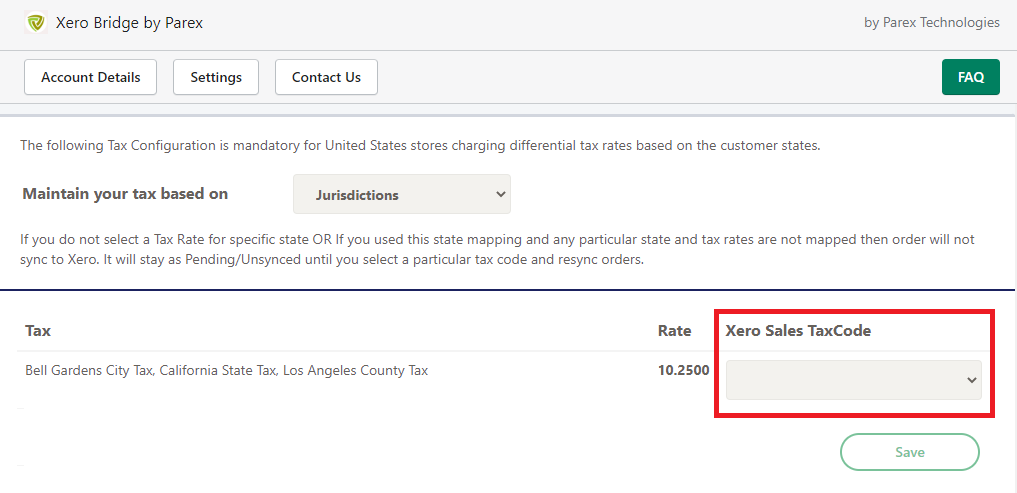

This error is received by the stores in USA, maintaining the tax based on jurisdiction. When "Xero Sales Tax code" is not selected in our app for the jurisdiction then all orders associated with that jurisdiction will not be synced due to this error.

When the first order from any jurisdiction is received in Shopify, then our app will auto detect the Shopify side of Jurisdiction automatically and display it in the tax setting in our app. The first order from the jurisdiction will be unsynced.

After the first order is received for any jurisdiction, you need to go to our App's Dashboard >> US Tax Settings and save the settings by selecting the respective tax code against tax rate because there may be same tax rates for many jurisdictions.

To get the Xero Sales TaxCode under the drop down list, it needs to be created in Xero first, then only it will be available to select. After the tax code is selected, you can navigate to our app's Dashboard >> Order List >> Unsynced orders page and resync that order.

If another order comes from the same jurisdiction next time then our app will identify the jurisdiction from the saved US tax settings and it will sync that order automatically.