Tags:

Tax sync

European countries tax

IOSS tax code

Configuring IOSS tax codes in Xero bridge app

This article explains how IOSS tax codes can be configured in Xero bridge app.

To configure IOSS tax codes in our app, first you need to create all the IOSS tax codes in Xero for all European countries. You can refer to the below article from Xero which shows setting up tax codes.

https://central.xero.com/s/article/Using-non-standard-tax-rates-UK#EnterOSSorIOSSsales

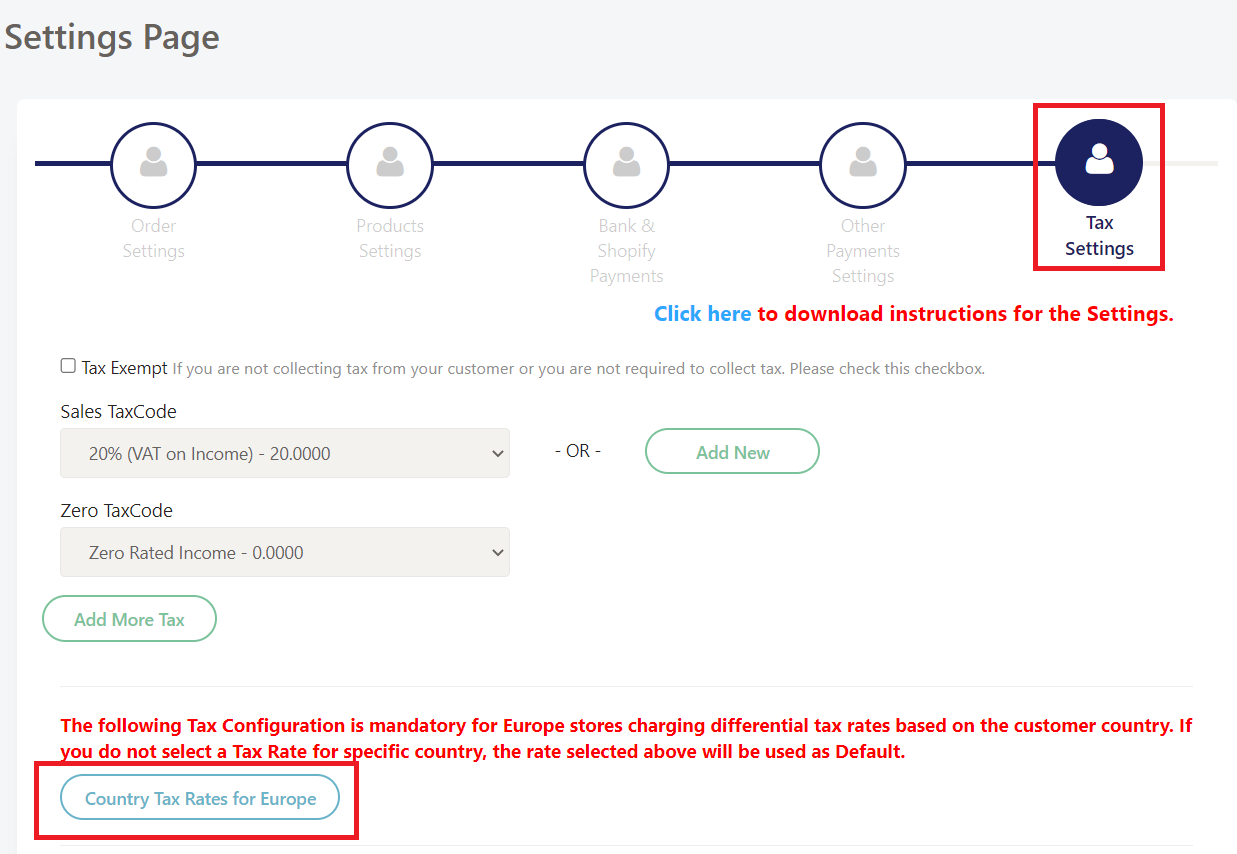

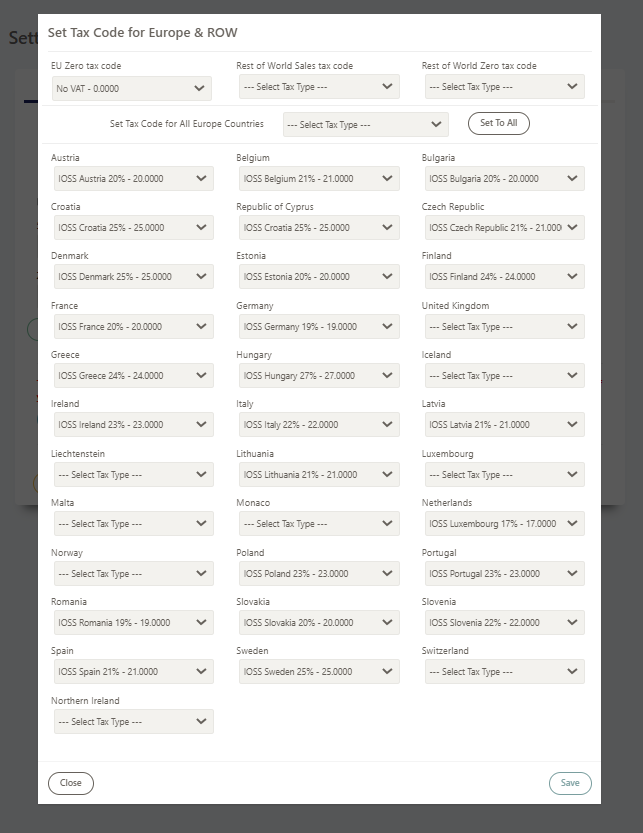

Once all tax codes are set up in Xero, you can nevigate to 5th tab of our app setings and click on "Country Tax rates for Europe". The pop up page will appear where you can select the relevant tax code for European countries from the drop down list. Please refer to the attached screenshots for your reference.

Once the tax codes are selected, save it by clicking on "Save" button and then click on "Finish" button loacated at bottom right corner of the 5th tab.

If there is a tax applied to an order in Shopify, our app will select the correct tax code for that country based on the settings you have done in our app and sync it to Xero. If there is no tax applied on the order in Shopify, then our app will apply the relevant tax code for 0% tax in the invoice in Xero.